- Language

-

- menu

Menu

The forex market is the biggest and most liquid financial market globally. It provides great opportunities for investors and traders. A financial tool that has gained popularity in this market is the Percentage Allocation Management Module or PAMM. PAMM is a unique investment method that offers investors great profitability and convenience. However, it is crucial to understand how the account works before investing.

A PAMM account is an investment tool developed by brokers for managing funds. In essence, it allows one trader, the PAMM manager, to handle their own capital and that of other investors, all from a single account.

The workings of a PAMM account are straightforward. The PAMM manager opens an account and allocates a certain amount of their own capital – which is known as the “Manager’s Capital.” The manager shares profits with investors based on the respective amount they deposited when profitable trades are made.

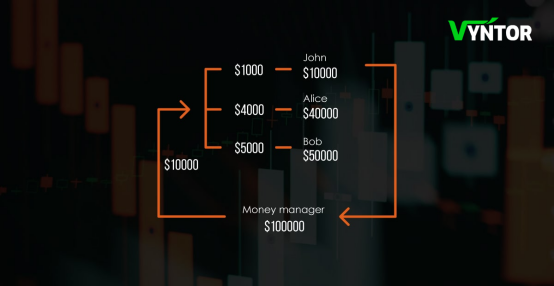

Imagine a scenario where there is a PAMM manager, John, with $10,000 of his own money. He opens a PAMM account, and two investors, Alice and Bob, decide to join him, investing $40,000 and $50,000 respectively. Now, the total capital in the PAMM account is $100,000.

The profit or loss from the trades John makes will be shared between John, Alice, and Bob proportionally. If John, the money manager, makes a profit of $10,000, he gets $1,000, Alice gets $4,000, and Bob gets $5,000, based on the corresponding amount they contributed to the total account balance.

The same holds true if the money manager is only trading for one client with an account balance of $50,000 and makes a profit of $5,000 (10%), the client will receive the entire amount. The same rules apply to any number of clients and each receives the loss or profit based on their account size at the beginning.

Clients retain ultimate control of their accounts and can take back the power of attorney for trading assigned to the money manager at any time. Clients can also set an automated stop loss order that prevents the money manger from trading once they hit a certain loss percentage.

PAMM clients can also decide to activate their accounts and give approval to join the money manager. The manager can choose whether to hold trades overnight or close then at the end of the day based on the clients preferences.

The PAMM manager is an experienced trader who trades for investors, taking a previously agreed percentage of their profits. Investors do not need to conduct trades and can rely on the manager’s expertise.

It’s important to understand that while PAMM accounts offer several advantages, they are not without risks.

| Benefits of PAMM | Risks of PAMM |

|---|---|

| 1. Accessibility: Allows investors to participate in Forex trading without needing detailed knowledge or experience | 1. Dependence on PAMM Manager: The success of the investment is heavily dependent on the manager’s skills and trading decisions |

| 2. Profitability: Potential for high returns if the PAMM manager is successful | 2. Potential for Loss: Risk of losing a part or all of the investment if the manager makes unsuccessful trades |

| 3. Diversification: Helps diversify investment portfolios | 3. Lack of Control: Investors have limited control over the investment strategies |

| 4. Time Efficiency: Investors don’t need to spend time trading themselves | 4. Manager Fees: Profitable trades are subject to manager fees, which can reduce the net return |

| 5. Flexibility: Investors can choose from various PAMM managers based on their risk tolerance and expected returns | 5. Broker Risks: Risks related to the broker’s credibility and reliability |

Consider the example of Linda, an inexperienced investor who opts to invest in a PAMM account managed by a seasoned forex trader instead of trying to navigate the volatile forex market on her own. After a year, she finds her initial investment has yielded a significant return, demonstrating the potential benefit of PAMM accounts.

However, PAMM accounts are not without risks. The main risk lies in the potential loss of part or all of the investment amount if the PAMM manager makes unsuccessful trades. For instance, David invested in a PAMM account, but the manager made several poor trades, leading to a loss of 20% of the initial investment. This highlights the importance of choosing the right PAMM manager.

PAMM are not the only option for investors looking to make profits from forex trading. Individual trading and other social trading platforms like MAM (Multi-Account Manager) and LAMM (Lot Allocation Management Module) are alternatives.

With individual trading, investors make their own trades. This option provides the most control but requires a deep understanding of the forex market. For instance, Peter, an experienced trader, prefers individual trading because he enjoys analyzing market trends and making his own investment decisions. Over a year, he achieves a 15% return on his investment capital.

On the other hand, MAM and LAMM accounts, like PAMM accounts, allow investors to benefit from the skills of experienced traders. However, they differ in how trades are allocated. MAM accounts allocate trades based on the investor’s account balance, while LAMM accounts allocate trades in pre-determined lot sizes.

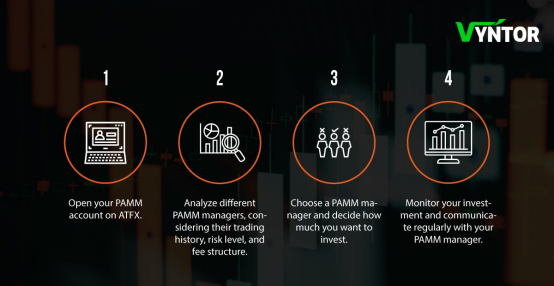

Selecting the right PAMM account is a crucial step in your investment journey. When selecting a PAMM manager, it’s important to take into account their trading history, risk level, fee structure, communication skills, and the degree of control you desire over your investment. Some PAMM accounts have a ‘stop-loss’ limit which helps to safeguard your capital.

For instance, Emma is looking to invest in a PAMM account. She researches different PAMM managers, carefully considering their trading performance, strategies, and fees. She finally chooses a manager who communicates well, has a proven track record, and whose risk level matches her own risk tolerance.

To start investing in a PAMM account, follow these steps:

Investing in PAMM accounts can provide an attractive opportunity for individuals looking to profit from the forex market without needing to be trading experts. It’s important to understand the workings of these accounts and their associated risks before committing to an investment. Always research thoroughly, ask relevant questions, and consider consulting a financial advisor to make well-informed decisions.

© VYNTOR.COM. All rights reserved.

Legal Statement: Vyntor Global Group Ltd is a company registered in the United States. It has completed registration and filing with relevant financial regulatory agencies in the United States and has the following compliance qualifications:

Registered with the U.S. Securities and Exchange Commission (SEC), registration number: 0002070907

Registered as a Money Services Business (MSB) with the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) with registration number: 31000300306142

Registered address: 1312 17th St #2199, Denver, OH, United States, Ohio

Risk Disclosure Statement

Contracts for Difference (CFD) are complex financial products that involve leverage and can result in a rapid loss of capital. Based on historical data, the majority of retail investor accounts lose money when trading CFDs.

Before deciding whether to participate in such transactions, investors should fully understand how they work and carefully assess whether they can bear the potential high risks based on their own financial situation. For more information, please refer to the full risk disclosure policy listed on pages 42 to 45 of the Standard Terms of Business.

Service Compliance Statement (International)

In accordance with local laws and regulations of each country, the promotion, marketing and customer acquisition activities of Vyntor Global Group Ltd's financial products and services may only be carried out by financial entities authorized by the relevant regulatory authorities in the target country or region, or their registered agents in accordance with the law. Before using the company's services, customers should ensure that their location allows access to and use of relevant financial services.

About VYNTOR Brand

VYNTOR is an international business brand used by multiple compliant financial institutions. The relevant entities include:

Vyntor Global Group Ltd

Authorized and regulated by the U.S. Securities and Exchange Commission (SEC)

Registration number: 0002070907

Registered address: 1312 17th St #2199, Denver, OH, United States, Ohio

Vyntor Global Markets (CY) Ltd

Regulated by the Cyprus Securities and Exchange Commission (CySEC)

License number: 285/15

Registered address: Maryvonne Building, Limassol, Cyprus

Vyntor Global Group Ltd (Finland Representative Office)

Regulated by the Finnish Securities Market Supervisory Authority (CySEC)

License number: 285/15

Registered address: Maryvonne Building, Limassol, Cyprus

Vyntor Global Group Ltd (Mauritius)

Regulated by the Mauritius Financial Services Commission (FSC)

License Number: C118023331

Registered address: The Catalyst Building, Ebène, Mauritius

VYNTOR MENA Financial Services LLC

Regulated by the Securities and Commodities Authority (SCA) of the UAE

License number: 20200000078

Emerging Markets

Acting as the agent of Vyntor Global Group Ltd in the Hashemite Kingdom

Regulated by the JSC

Agent License Number: 643

Vyntor Global Group Ltd (Saint Vincent and the Grenadines)

Register as a limited liability company

Company ID: 333 LLC 2020

Registered Address: Euro House Building, Kingstown, St. Vincent and the Grenadines

Vyntor Global Group Ltd (Spain Representative Office)

Office address: Spaces Río, Calle Manzanares 4, Madrid, Spain

Scope of application statement

The information contained in this website is not intended for residents of the United States, Belgium, the United Kingdom or other countries or regions where the dissemination of relevant information is prohibited by law or regulation. Before using the information or services provided by this website, users must confirm whether the access and use of such content is permitted in their jurisdiction.

VYNTOR UK (AT Global Markets (UK) Ltd.) focuses on developing institutional business and professional investors and does not accept retail clients under its UK Financial Conduct Authority (FCA) license.

For professional client applications, please contact [email protected] .

🌍 Welcome to VYNTOR!

To provide you with the best trading experience in Iraq, please visit our localized website:

There, you’ll find all products, services, and contact information tailored specifically for you. Thank you for choosing VYNTOR!

Restrictions on Use

Restrictions on Use

Products and Services on this website are not suitable for the UK residents. Such information and materials should not be regarded as or constitute a distribution, an offer, or a solicitation to buy or sell any investments. Please visit /en/ to proceed.

Restrictions on Use

Please note, you may be accessing this page from outside Australia. Products and Services on /en-au/ may not be suitable in your country. The information provided should not be considered as an offer, solicitation, or distribution for any investments.

Restrictions on Use

Products and Services on /en-au/ are not suitable in your country. The information provided should not be considered as an offer, solicitation, or distribution for any investments.

Choose another region to see content specific to your location.

Restrictions on Use

Products and Services on this website are not available for Hong Kong investors and not related to any corporation licensed by the Securities and Futures Commission in Hong Kong.

All the information and materials posted on this website should not be regarded as or constitute a distribution, an offer, solicitation to buy or sell any investments.

使用限制:本網站的產品及服務不適用於香港投資者及與任何香港證監會持牌公司無關。

網站內部的信息和素材不應被視為分銷,要約,買入或賣出任何投資產品。

Restrictions on Use

AT Global Markets (UK) Limited does not offer trading services to retail clients.

If you are a professional client, please visit

https://www.vyntor.com/